Is the unicorn factory okay?

And what does it have to do with the booming attention economy?

What’s the connection between the attention economy that seems to be booming and the troubles with the “unicorn factory” model of startup building?

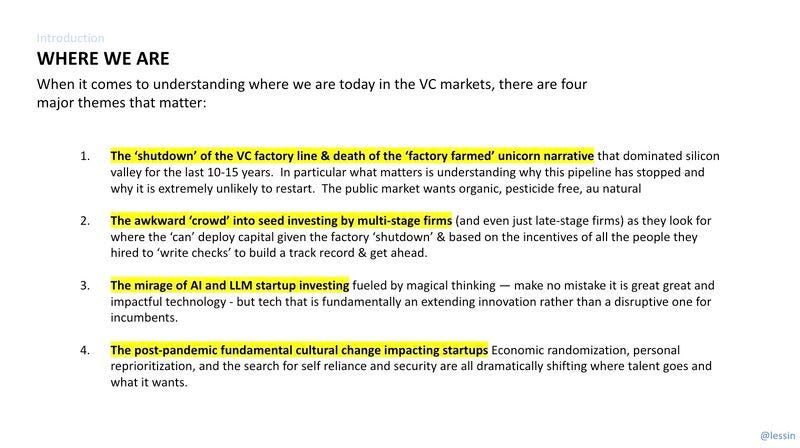

A year ago, Sam Lessin, GP at Slow Ventures, wrote a long deck that made a number of bold claims. The biggest one was that the “unicorn factory” was over.

Simply put, nearly everyone reading this, as well as me, only ever worked in the “unicorn factory” world, where entrepreneurs and investors specialised in various stages like “seed investor”, “series A investor”, “founder, but not CEO”, or “scale-up CEO”, etc. The job was to get the business from one milestone to the next, where someone else, specialising in the next part of the “unicorn factory”, would take the baton.

Then, Nicolas Colin articulated his view in this essay, also building on Sam Lessin’s thinking:

In this essay, Nicolas makes the following argument. More expensive money, coupled with deglobalisation (addressable markets getting smaller) and the increasing ability of large firms to innovate, will dramatically alter the startup landscape in three ways (read his essay for details, it’s worth it):

First, the unicorn factory will cease to exist because it’s only viable if there’s real money at the end of it. However, public markets aren’t willing to support the sky-high valuation of unicorns built over the last decade.

Second, the VC world will return to “traditional” investing, making bold bets on foundational technologies at reasonable valuations. In plain English, no more “Uber, but for pet horses”. Or the VCs will continue making bets on teams that can be truly world-class at execution in B2B SaaS. (The rest of VCs will be going out of business.)

Third, large businesses with the capital and talent to innovate will drive much of the innovation. It’ll be more challenging for small teams to run circles around “big and sluggish” incumbents because big companies are as big and rich as ever but aren’t as sluggish when executing new ideas anymore.

Sam Lessin and Nicolas Colin published these arguments a year ago, but I found myself thinking they’re still relevant.

It feels as if founders are trying hard to play by the “unicorn factory” rules because that’s the only thing that founders and investors under 45 know, but it’s not how it works anymore. Were Lessin and Colin right a year ago?

I also wonder if the growing attention economy that I wrote about earlier is part of the picture. More and more people are trying to learn to capture others’ attention, most visibly on LinkedIn and other social media.

Maybe the most visible example is Elon Musk. Three weeks ago, Matt Lerner posted:

If Tesla were really worried about earnings, they'd release the Roadster and eat half of Porsche's business in a year.

But they're focused on self-driving, the Optimus robot and the robotaxi. There might be a huge market for all of those things. I don't know. It's unproven.

To which, I replied:

If they were going after proven markets with proven products, they'd have Porshe's market cap, which is 30B vs Tesla's 700B.

Their future huge markets may or may not exist, but going after them allows them to reap the rewards in the present.

In other words, hype pays off.

Could this be the logical consequence of the challenges with the “unicorn factory” model? Feeling that the “old” rules of building startups aren’t quite working in many cases, entrepreneurs are trying to overcompensate with learning how to capture attention at scale?

I don’t have a conclusive answer, and my thinking is very raw on this topic, but I do have a sense that something in the startup land is shifting in meaningful ways, so I’m trying to make sense of it. I also suspect the AI boom is also a big part of the picture, but that’s for another essay.

Would love to hear your perspectives.